Startup funding in decline, but early-stage hits peak in Aus

Early-stage funding reached record levels with a growing number of founders backed in 2022. The Pre-Seed and Seed stages proved to be particularly successful, defying the fall in overall investment by accumulating around $3.2 billion.

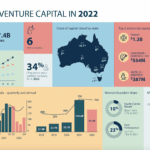

Startup funding in Australia experienced a decline of 30% in 2022 ($10.6 billion – to $7.4 billion), according to the second annual edition of The State of Australian Startup Funding report by Cut Through Venture and Folklore Ventures.

Despite the mid-year slow down, 2022 was a record year for the very early deals. There has been real maturing in Australia’s early stage investing landscape.

– Kylie Frazer, Co-Founder and Partner, Flyin Fox Ventures

Here’s a bit of recap:

- Startup funding hit $7.4 billion in 2022

- 30% fall from record 2021

- Investors made 712 deals

- Great time to be early-stage

- Female founders get more deals, but way less dollars

- Record year for venture debt and crowdfunding

- 6 new unicorns crowned

Early-stage hits a record high

Even with a 3% drop in the number of deals announced in 2022 compared to the record number in 2021, sub-$5M rounds saw a growth of 13% while $5-20M rounds remained steady. However, deals larger than $20M experienced a significant decline of 27% from 2021 levels. Interestingly, Australia bucked the trend of dropping funding for pre-seed and seed stages in the US and Europe.

One notable aspect is the flourishing of Australia’s early-stage funding scene. The country now boasts a robust pool of local professional venture funds, family offices, angel networks, and experienced individual investors willing to invest in startups at their earliest stages. This includes both new funds and existing funds that shifted their focus to earlier stages or doubled down on their early-stage mandate. Moreover, conditions were favourable for launching a startup or raising a small early-round in 2022, against local and global funding market uncertainty.

Despite the promising outlook, investors reported longer fundraising processes, indicating a longer time to decide on investments, even with a strong appetite to invest. Additionally, early-stage deals were reported to be more competitive than ever, according to more than a third of investors. The top three funds Airtree, Blackbird and Square Peg raised $2.4 billion in new funds last year, with Blackbird raising Australia’s first $1 billion VC fund. This highlights the continuing interest and investment in the Australian startup ecosystem.

To modify Bill Gates’ quote to describe the Australian startup ecosystem: you will overestimate the data from a year and underestimate it over a decade. To look back and see the rise of our ecosystem over the last decade has been unimaginatively stunning. I can’t wait for the next one.

– Niki Scevak, Co-Founder and General Partner, Blackbird VC

The report co-author and founder of Cut Through Venture, Chris Gillings, stated that while there is plenty of dry powder in VC wallets for the years ahead, it is being deployed more cautiously. This is because limited partners (LPs) in VC funds now demand a more conservative investment cadence and portfolio companies have been told to reduce costs. And with all this, more than 60% of founders still plan to raise their next capital round in 2023.

Regardless of the decline in overall investment, the Australian startup funding environment remains competitive, with early-stage investment booming. The growth story of local investment in such a short time remains astonishing, with investment reaching $7.4 billion in 2022, which is still five times bigger than 2018’s $1.4 billion. While challenges persist, Australia’s startup ecosystem is maturing, and the funding environment will periodically expand and contract.

The full report is available for free from here.

Related posts

Visionary Behind the Bionic Ear Honoured in 2024 Pause Awards Hall of Fame

3 December, 2024

Australia’s boldest innovators announced and new chapter for 2025

3 December, 2024

Top five winners score the most invaluable encounter

19 November, 2024

How Ally Watson is pioneering tech careers for women

15 November, 2024

Breakthrough Insights, Strategies, Creativity and Culture for now

12 November, 2024

Life lessons on ownership and how to keep creative control

6 November, 2024

How to unlock the intangible in brand equity with 4P’s

29 October, 2024

Discover trailblazing Finalists of Pause Awards 2024 in Australia

28 October, 2024

Why Bunnings feels like home: trust, community and genuine care

23 October, 2024

Why creativity and imagination will save the world

22 October, 2024

How Canva transformed a simple idea to become global leader

15 October, 2024

How NASA’s new AR tech will take astronauts to the next frontier

11 October, 2024

How to build authentic workplace culture

7 October, 2024

How to balance business growth with personal wealth

24 September, 2024

A time to dream big with Kristina Karlsson

16 September, 2024

The purpose of gatekeepers in authentic brand storytelling

6 September, 2024

It’s here, a final call to enter the Pause Awards this year

3 September, 2024

Join a free 7-week online learning on the go

3 September, 2024

Pause Awards partners with Ticker for exclusive broadcast coverage

6 August, 2024

Calling Melbourne — a significant player to enter!

6 August, 2024

Calling Hobart — an emerging hub to enter!

26 July, 2024

Calling Canberra — with most daring new ideas to enter!

16 July, 2024

Meet final judges and why they love Pause Awards

15 July, 2024

Meet even more judges and why they love Pause Awards

8 July, 2024

Meet more judges and why they love Pause Awards

5 July, 2024

Calling Adelaide — dynamic centre for innovation to enter

4 July, 2024

Meet the judges and why they love Pause Awards

1 July, 2024

Maybe those shouldn’t have been there in the first place

27 June, 2024

Calling Perth — an emerging innovator to enter!

25 June, 2024

Read a thrilling mid year predictions by the judges

24 June, 2024

Jasmine Batra’s Breakthrough Moment

24 June, 2024

WithYouWithMe’s Breakthrough Moment

24 June, 2024

Paz Pisarski’s Breakthrough Moment

20 June, 2024

UpStock’s Breakthrough Moment

20 June, 2024

Calling Brisbane — a rising star to enter!

19 June, 2024

How to choose the right category for the Pause Awards?

17 June, 2024

Success stories of past Pause winners

17 June, 2024

Your guide to the Pause Awards entry process

17 June, 2024

Understanding the breakthrough question

17 June, 2024

Top 10 tips on how to enter Pause Awards

17 June, 2024

Calling Sydney — a powerhouse of opportunity to enter!

6 June, 2024

Inke’s Breakthrough Moment

6 June, 2024

ReSource’s Breakthrough Moment

3 June, 2024

Brittany Garbutt’s exchange with Paul Bassat on building and sustaining a business empire

21 May, 2024

Entering Pause Awards for the first time?

21 May, 2024

Inside the Pause Awards 2024: A universe of possibility

14 May, 2024

What’s a Pause Awards breakthrough?

14 May, 2024

Marcella Romero’s Breakthrough Moment

9 May, 2024

Music Health’s Breakthrough Moment

2 May, 2024

Chau Le’s Breakthrough Moment

30 April, 2024

Tanck’s Breakthrough Moment

26 April, 2024

Macro Mike’s Breakthrough Moment

23 April, 2024

Birchal’s Breakthrough Moment

18 April, 2024

Tixel’s Breakthrough Moment

16 April, 2024

Redefining success with Angus and Neil of Tanck

15 April, 2024

Quad Lock’s Breakthrough Moment

12 April, 2024

Origin Energy’s Breakthrough Moment

10 April, 2024

Mel Stubbing’s breakthrough moment

5 April, 2024

Brittany Garbutt’s breakthrough moment

2 April, 2024

InvestorHub’s Breakthrough Moment

28 March, 2024

Kollektive’s Breakthrough Moment

26 March, 2024

Talking robots and AI Agents, two insane demos

25 March, 2024

Fight Club and Zombie VCs

25 March, 2024

WeMoney’s breakthrough moment

20 March, 2024

Addressing gender inequality with 21.7% discount for female-led companies

8 March, 2024

How Entertainment Brands are winning hearts and minds

5 March, 2024

2023 packed a punch

17 January, 2024

The power of relationships with Dom Pym at Pause Awards Night

19 December, 2023

Six years of celebrating the Australian most ambitious innovators

5 December, 2023

M&A green shoots & scandal central

10 November, 2023

Announcing the 63 ambitious finalists, 3 winners and Pause Awards Night

30 October, 2023

Can optimism and curiosity win the battle with Ai

20 October, 2023

Looking at 100 years from now in Solar, EVs and MedTech

20 October, 2023

What does the Australia’s VC landscape look like in 2050

19 October, 2023

Do we want to live in a Black Mirror world?

17 October, 2023

Four new emerging directors envision sustainable future beyond 2050

6 October, 2023

Visible Founders puts a spotlight on migrant entrepreneurs

28 September, 2023

Always be closing & IPO, no?

24 September, 2023

Strong commitment needed to run tech events in Australia revealed at GEC23

24 September, 2023

iPhone 15 event: everything about Apple’s new product line

14 September, 2023

Discover the colourful world of oral hygiene with Dsmile’s new range

13 September, 2023

How to build a company culture in dynamic market

8 September, 2023

The valuable startup lessons hidden in the film Oppenheimer

7 September, 2023

Meet the new addition to the Judging Board ‘23

4 September, 2023

Advice on Design Thinking for stellar product development

1 September, 2023

How Pause Awards can put your brand on the map

30 August, 2023

Seize the moment: New Extended Entry Deadline

30 August, 2023

I got 99 problems

26 August, 2023

Is AI the new frontier of creativity and business

25 August, 2023

Tech legends unite to guide growth and foster innovation

22 August, 2023

The new faces of Pause Awards in business and the product officers

21 August, 2023

Don’t miss out on the last chance to join champions

21 August, 2023

Experience is a new frontier for brands

18 August, 2023

How to grow an idea into a great product

11 August, 2023

Good storytelling and trust will fuel startup and brand growth

4 August, 2023

Twitter to X: a rebrand to challenge tech giants and empower users

4 August, 2023

Discover the latest tech predictions of 2023

1 August, 2023

Elevate your business with Stephen Hunt’s success secrets

31 July, 2023

Lean into digital marketing trends now and in 2024

28 July, 2023

The new faces of Pause Awards from agency and media innovation

25 July, 2023

Hit it, DJ! and other local newsings

24 July, 2023

Female-led ethical fintech Verve raises $3M for Verve Money

21 July, 2023

How to better tune into your success journey

21 July, 2023

Pause Fest’s BREAK–THROUGH SESSIONS will keep you scaling

12 July, 2023

How to choose the right awards for your business

5 July, 2023

The new faces of Pause Awards in strategy and leadership

4 July, 2023

We’re building the community for the most ambitious people

27 June, 2023

It was worth waiting for these unique features

26 June, 2023

Mapping the future of fit and function

23 June, 2023

Midnight Health secures $24 million funding boost

21 June, 2023

Championing breakthroughs in today’s business world

21 June, 2023

OpenAI’s Sam Altman says hai

19 June, 2023

Top 5 compelling reasons why you should enter

18 June, 2023

Pause Awards vs Webby’s, Cannes Lions and Effies

18 June, 2023

The new faces of Pause Awards in startup, product and experience

15 June, 2023

A tour of 11 new categories

12 June, 2023

Inside out of Pause Awards

5 June, 2023

Aim for the Diamond: Understanding the Different Categories

1 June, 2023

The new faces of Pause Awards in strategy, growth and innovation

30 May, 2023

Where business recognition gets a paradigm shift

24 May, 2023

Industry leaders predict a transformative year ahead

17 May, 2023

Pause Awards grows to $412 Billion ecosystem

17 May, 2023

Shaking it up with new Investable Score™

17 May, 2023

Tap into your inner powerhouse

5 May, 2023

Life in the fast (tech) lane

24 April, 2023

evee rides the electric wave

18 April, 2023

Big win for the female-led business Circle In, lands $2 Million

14 April, 2023

Designing global empires:

How local brands can conquer the world

10 April, 2023

A passionate pursuit for Healthcare reinvention

4 April, 2023

The game-changing sessions at SXSW Sydney

30 March, 2023

Top AI tools you need to try now

29 March, 2023

A journey to revolutionising healthy school lunches

28 March, 2023

Panic! at the SVB & metrics that matter

16 March, 2023

Call for Entries

opens on 17 May ‘23

1 March, 2023

Music for wellbeing:

The healing power of sound

20 January, 2023

Deep dive with ChatGPT about Aussie tech ecosystem

17 January, 2023

How it started; How it’s going 2022

17 December, 2022

Learning from mistakes and how to tackle the upcoming headwind

14 December, 2022

Claiming your PauseNFT trophy

13 December, 2022

Women and purpose led businesses take the most wins at Pause Awards ‘22

6 December, 2022

Professor Fiona Wood – The pioneer of ‘Spray-on-Skin’ technique, ReCell.

6 December, 2022

Rise and Demise

28 November, 2022

Let’s have breakfast with champions?

15 November, 2022

82 Bold Finalists Announced for the Pause Awards ‘22

10 November, 2022

Judge Sessions with Lumigo, Tribal DDB and Clipboard Hospitality

24 October, 2022

Judge Sessions with LongView, Fullstack and Art Processors

20 October, 2022

The first look at the new wearable trophy design

13 October, 2022

The Public Voting is open, go get them!

10 October, 2022

Cash to splash & other VC news

2 October, 2022

The Final Deadline Extended to midnight 14 October

30 September, 2022

Judge Sessions with Wavia, SEIKK and MedTech Actuator

26 September, 2022

Pause Awards Wins Australia’s International Good Design Awards for Design Excellence

19 September, 2022

Judge Sessions with Synergy Group, AOK Creative and i4 Connect

16 September, 2022

A word with Birchal’s Co-Founder – Matt Vitale

6 September, 2022

What can Pause Awards bring to your company

30 August, 2022

Google, Synergy Group, Spaces Interactive, Safari and By Jacs judges for Culture categories

24 August, 2022

Loyal VC, Media.Monks, AOK Creative, Storyfolk and Irene Lemon judges for Good categories

15 August, 2022

Fullstack, Lumigo, Netambition, MedTech Actuator and Unhedged judges for Operators categories

10 August, 2022

A word with Heaps Normal’s Head of Brand – Peter Brennan

9 August, 2022

Tribal DDB, We Are Unity, Bullfrog, BeautifulAgile and The Audacious Agency judges for your Excellence

2 August, 2022

Simply Wall Street, IBM, Forestlyn, CFOWorx and Accenture Song are this year Growth Judges

1 August, 2022

Venture snapshot: down but not out

26 July, 2022

Best equity crowdfunding year in Australia – $86m!

22 July, 2022

How to navigate the awards Entry Portal?

14 July, 2022

Startup Genome ecosystem report 2022 review

10 July, 2022

We’re giving a voice to our community with a stylish newsroom design

10 July, 2022

Professor Martin Green

– The father of solar cells

10 July, 2022

Dr John O’Sullivan

– The inventor of modern WiFi

10 July, 2022

14 New award categories under five tracks to highlight the ecosystem success

5 July, 2022

M&A on the rise & the EV SPAC demise

29 June, 2022

Our new vision:

The home for champions

27 June, 2022

Awards LIVE Briefing and Entry Kit

22 June, 2022

The Porsche of awards programmes with community at its heart

21 June, 2022

The Sheet Society

– Success Stories

17 June, 2022

We’re looking for our final few judges – could you be one?

8 June, 2022

Single Use Ain’t Sexy

– Success Stories

1 June, 2022

Afterpay

– Success Stories

24 May, 2022

This is how we celebrate innovation champions

15 December, 2021

The most ambitious and forward-thinking companies in Australia revealed

24 November, 2021

Pause Awards 2021 Finalists Skyrocket

17 November, 2021

Final Deadline is Looming

1 September, 2021

Get to know:

Carolyn Breeze – Judge

24 August, 2021

Get to know:

Will Hayward – Judge

17 August, 2021

Get to know:

Shamila Gopalan – Judge

10 August, 2021

Get to know:

Tom Leyden – Judge

3 August, 2021

Get to know:

Jules Brooke – Judge

26 July, 2021

Get to know:

Jamie Finnegan – Judge

18 July, 2021

Early Entries end This Week

12 July, 2021

Need Help Entering Pause Awards?

6 July, 2021

2021 Award Category Guide

1 July, 2021

How to Enter The Pause Awards in 7 min?

25 June, 2021

Get to know:

Melanie Rayment – Judge

24 June, 2021

Past winners:

where are they now?

24 June, 2021

Pause Awards 2021 opens for entries

9 June, 2021

New categories revealed for Pause Awards 2021

5 June, 2021

Meet the Judging Board 2021

13 May, 2021

The Reign in the North

1 February, 2021

What went into creating Vincent, a hyper-real digital human

21 January, 2020

Dane O’Shanassy on Patagonia’s moral compass and commercial success

6 November, 2019

Pause index

Providoor

I Wish I'd Done That

Aussie Broadband

Hammer

Michelle Akhidenor

Prodigy

Circle In

Circular Pioneer

Removify

Defiant Ones, I Wish I'd Done That

Kismet Healthcare

Defiant Ones, On The Rise

Evan Buist

Creative Maverick

InvestorHub

Great Pivot

Zeep

Hammer

Law On Earth

B-Good

AECO Energy

Going Green