Always be closing & IPO, no?

Welcome to Ignition Lane’s Wrap, where they cut through the noise to bring you their favourite insights from the technology and startup world.

💯

We’ve officially made it to the 100th edition!

We started the Wrap in the throes of Melbourne’s first lockdown in May 2020, as another way to stay connected asynchronously (remember that buzz word?) with clients and friends.

At the time, our world’s economic future felt uncertain. People were learning to adapt to new ways of working, tech teams were squeezing a decade’s worth of digital transformation into weeks and months, and businesses across the board were cutting costs. History repeats itself.

Since then, the startup, tech and VC world has arguably undergone the biggest shift in history.

We saw the rise and fall of: NFTs, a crypto bonanza, Clubhouse, an obsession with product led growth, 10 minute grocery delivery, monstrous valuations, mega VC rounds and (occasional) poor due diligence. The number of VC funds exploded, and now many are grappling with how/whether to raise their next fund, or wind down.

Related: interesting piece on Tiger Global’s history.

Some things remained constant: Elon Musk’s domination of our newsfeeds, cyberattacks, remote/hybrid collaboration, the war for exceptional talent, high quality startup accelerator programs and government support for the local startup ecosystem. Being a founder or startup leader continues to be hard (we can help lighten your load).

And other things have intensified: Canva’s brilliance, the pressure to drive profitable growth, the growing talent pool of incredible people with startup experience ready to tackle the world’s biggest challenges – from climate change to healthcare, retail ad media and, of course, there’s AI and LLMs.

Our first Wrap featured some sage advice from Blackbird’s Niki Scevak, which is as relevant now as it was then:

- economic shock should be a moment to look hard into the mirror.

- What have you been kidding yourself about?

- Now is also your greatest opportunity to change course, to confront your uncomfortable truths, and to seize a once in an economic cycle’s buffet of opportunities.

- Wrap #1 went out to just 22 people. Now the Wrap reaches thousands.

Thank you for the love, the likes, the shares, the kind words and the critique. Keep it coming. We wouldn’t be here without you.

Local newsings

Canva turned 10. Cofounder and CEO Melanie Perkins shared her lessons from building the company. Fun Canva fact #1: Investors who put $1,000 into Canva’s first investment round would now have nearly $5m based on its latest valuation. Fun Canva fact #2: Early investor and former top Google executive, Wesley Chan, says Canva’s “competitive advantage lies in its ability to attract the world’s best engineering talent.” It receives more than 300,000 job applicants a year.

Employer’s market? New data from Seek shows tech job ads are down 35% compared to last year. Specialist tech recruiters say salaries and contractor rates have fallen up to 15% for some roles, although cybersecurity, cloud, data and AI remain in high-demand.

In need of a new skill? Check out 100 jobs of the future.

Fuelling the AI pipes. NextDC is investing nearly $1 billion into data centres to support extraordinary AI-related demand this FY. Business is booming. NextDC signed the largest amount of new contracts in its history during the 12 months to June 30, with customer numbers increasing 13% to 1,820. The company is forecasting revenue in the range of $400-$415m this FY.

Meanwhile, despite the number of visits to ChatGPT’s website falling for three months in a row, OpenAI is exceeding revenue expectations. It has already passed US$1b ARR.

♻️to infinity and beyond. Samsara Eco unveiled $25m plans to create the nation’s first R&D hub dedicated to infinite recycling of plastic.

Crypto krakdown. ASIC launched legal action against crypto exchange Kraken, alleging more than 1,100 customers lost $13m on a product that didn’t meet regulatory rules. In other crypto news, US$41m worth of assets were stolen from Stake.com.

Winner winner. Melbourne-based (but US-founded) Startmate Winter ‘23 cohort company BioticsAI took home the almighty TechCrunch Disrupt Startup Battlefield Cup and US$100,000 this week.

BioticsAI has built an AI-based platform that plugs into an ultrasound machine to prevent fetal malformation misdiagnosis. The startup is able to identify fetus malformations with a high level of accuracy, validate the quality and completeness of the screening and then extract all the information to automatically generate reports.

Startup Daily held its Best in Tech awards, winners included: Most innovative: Q-CTRL (Quantum infrastructure software); New founder: Molly Fullee (wind-sensor technology that can help accelerate the transition to net zero); Sustainability: Goterra (fly maggot food waste munchers).

Quick things:

- Poddy: Our friends Adam Schwab (Luxury Escapes CEO & Cofounder) and Adir Shiffman (Catapult Chair, investor) launched an excellent business podcast – The Contrarians.

- Conference: Tank Stream Labs is organising the first Startup to Scaleup Summit in Sydney on Thurs 16 November.

- Partnerships: BVP released a GTM guide to building SaaS channel partnerships. Bryan Williams shared key learnings from Partnership Leaders’ Catalyst Conference.

- Lists: The Australian released its List of top 100 Innovators.

ABC: Always be closing

U.S. VC Lightspeed released its Sales Benchmark for 2023. Handy data points.

The tl;dr: Winning new deals is not only more difficult, it’s also taking longer -especially for US$100k+ price points.

In the first half of the year, 63% of companies missed their revenue targets. Even more concerning, 27% of those companies missed their revenue targets by more than 21%, indicating significant challenges. However, renewal rates have largely remained consistent.

Large transactions take time. US$250k+ deals are taking 6 months plus to close. Smaller transactions (under US$99k) are generally taking over 4 months.

Some top tips on surviving this market:

- Deeply evaluate product market fit. In the current economic climate, only “must have” products will get through the buying process.

- Focus on expansion opportunities, i.e. upsell or cross-sell existing customers.

- Invest in sales enablement to improve productivity. Ensure your sales team understands a potential customer’s key priorities and pain points, and can adapt the product’s pitch to match the customer’s goals.

- Ensure you are engaging the decision maker(s). Don’t get surprised to find you need the sign-off of multiple C-level execs.

- Continually re-forecast revenue and revisit the sales pipeline. Take a conservative approach to (1) the probability of deals closing, and (2) modelling when new revenue will hit the P&L.

Local M&A & Venture News

Mr Yum and Me&u finally agreed to merge the two QR code ordering businesses in an all-stock deal.

Blackbird-backed US-based Fig was acquired by AWS to “enhance the developer experience” and help them to code faster.

Fitness startup Steppen was acquired by Alta.

Produce marketplace Foodbomb was acquired by hospitality ordering company Ordermentum. Ordermentum raised $16m as part of the acquisition, giving the combined business a $100m valuation.

Small business invoice lender Waddle has traded hands from Xero to CommBank’s X15ventures.

Xero acquired the lender in 2020 for $31 million, also offering an additional $49 million in earn out. But in March this year, just weeks after Sukhinder Singh Cassidy took over from Steve Vamos as Xero CEO, she wrote off the cloud-lending platform at a cost of up to $40 million as part of cost cutting measures.

AMP (founded by the people behind TradeGecko and Advocately, Cameron Priest and Patrick Barnes) secured US$18.5m (A$28.5m) for their ecommerce solution consolidating sales, shipping and analytics tools. AMP has already acquired three businesses to build out its functionality: checkout and conversion startup AppHQ, shipping platform Addition, and analytics tool Lifetimely.

The Victorian government’s $2bn investment fund, Breakthrough Victoria has backed five Victorian universities to help them better commercialise research, committing $43.5m in matched funding ($87m total).

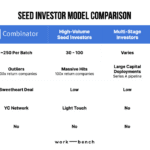

Good piece on different Seed investor biases and incentives:

Note, the above is US-centric. Equally, founders should be wary of expecting meaningful support from investors in ANZ. We find that the level of support you’ll receive depends on the individual Partner’s capacity and capability, as well as your startup’s growth trajectory.

Are big exits back? And other U.S. news

IPO, no? Over the last two weeks we saw the first big tech IPOs in aaaages – Instacart, Klaviyo and Arm. But no long-lasting pops, which leads us to questions whether the IPO window is really open:

- On 14 Sept, Chip designer Arm priced its IPO at $51 a share ($54.5bn valuation) and surged as high as $69 on its second trading day. But the price has since fallen back down to $51. Arm’s FY23 revenue was $2.7bn and was flat from the previous year.

- On Tuesday, grocery delivery/retail ad media firm Instacart sold its shares for $30 a pop in its IPO ($10bn valuation – well below its peak of $39bn in 2021). Shares surged 40% on the first day of trading, but the price then settled down to $30. It reported H1 2023 profits of US$242m and $1,475m in revenue.

In other grocery delivery news: Getir (might be last-man-standing in one-hour grocery) managed to raise another $500m round, though at $2.5bn vs $13bn in 2022. Also, the FAA cleared UPS drones for flight beyond line-of-sight. Early days, but this signals drone delivery could is on the horizon. - On Wednesday, marketing automation firm Klaviyo also priced its shares at $30 (valuation of $9.2bn) in its IPO. It generated $473m in revenue last year, a 63% increase from the year prior, and now has 130,000 customers. Shares were up 10% at the time of writing.

Big exits back? Networking giant Cisco bought Splunk for US$28bn cash (a 30% premium to Splunk’s share price) to strengthen its cybersecurity and observability play for enterprises. This is the year’s biggest deal, as well as Cisco’s biggest acquisition to date.

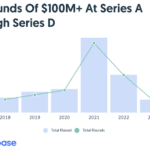

Megarounds are getting rarer by the minute. Crunchbase reports that a majority of the $100M+ U.S. funding recipients are in the sustainability, AI or healthcare categories.

Apple went viral by turning a boring sustainability report into storytelling gold.

Apple’s future in China is starting to look a little shaky after the government has reportedly banned iPhone use for government employees at work, on security grounds. Almost all Apple hardware is made in China and the country also makes up 20% of revenue.

Casino heist. UNC3944 or Roasted 0ktapus is reportedly behind a cyberattack against Vegas casino giants MGM and Caesars. MGM experienced widespread system outages and service disruption, taking down hotel card keys, ATMs, gaming machines. Caesars also paid out $15m after a ransomware attack saw the breach of social security numbers, drivers licenses and other personal information.

1 video to rule them all

Looking back through the archives, the best video still remains: Lawyer to Judge “I’m here live. I’m not a cat.” I’m not a cat!

That’s a wrap! We hope you enjoyed it.

Bex, Gavin and the team at Ignition Lane

–

Gavin and Bex make it their business to know everything going on in technology, startups and venture capital.

Gavin is the Founder and CEO of Ignition Lane. He has 25 years of experience in the technology industry across startups, corporates and venture capital. Gavin was a founding Partner at venture capital firm Square Peg, an SVP of Product and Technology at Experian, and was one of the first employees and CTO at Hitwise – a venture-backed startup that was acquired for US$240m in 2007.

Bex is a founding Partner at Ignition Lane. Driven by curiosity, her career is the epitome of unconventional – spanning technology commercialisation and operations, corporate law, IT delivery and more. Applying this unique mix of skills and experience, she now works with CEOs and their teams to solve problems, drive growth and move beyond the status quo.

Related posts

Visionary Behind the Bionic Ear Honoured in 2024 Pause Awards Hall of Fame

3 December, 2024

Australia’s boldest innovators announced and new chapter for 2025

3 December, 2024

Top five winners score the most invaluable encounter

19 November, 2024

How Ally Watson is pioneering tech careers for women

15 November, 2024

Breakthrough Insights, Strategies, Creativity and Culture for now

12 November, 2024

Life lessons on ownership and how to keep creative control

6 November, 2024

How to unlock the intangible in brand equity with 4P’s

29 October, 2024

Discover trailblazing Finalists of Pause Awards 2024 in Australia

28 October, 2024

Why Bunnings feels like home: trust, community and genuine care

23 October, 2024

Why creativity and imagination will save the world

22 October, 2024

How Canva transformed a simple idea to become global leader

15 October, 2024

How NASA’s new AR tech will take astronauts to the next frontier

11 October, 2024

How to build authentic workplace culture

7 October, 2024

How to balance business growth with personal wealth

24 September, 2024

A time to dream big with Kristina Karlsson

16 September, 2024

The purpose of gatekeepers in authentic brand storytelling

6 September, 2024

It’s here, a final call to enter the Pause Awards this year

3 September, 2024

Join a free 7-week online learning on the go

3 September, 2024

Pause Awards partners with Ticker for exclusive broadcast coverage

6 August, 2024

Calling Melbourne — a significant player to enter!

6 August, 2024

Calling Hobart — an emerging hub to enter!

26 July, 2024

Calling Canberra — with most daring new ideas to enter!

16 July, 2024

Meet final judges and why they love Pause Awards

15 July, 2024

Meet even more judges and why they love Pause Awards

8 July, 2024

Meet more judges and why they love Pause Awards

5 July, 2024

Calling Adelaide — dynamic centre for innovation to enter

4 July, 2024

Meet the judges and why they love Pause Awards

1 July, 2024

Maybe those shouldn’t have been there in the first place

27 June, 2024

Calling Perth — an emerging innovator to enter!

25 June, 2024

Read a thrilling mid year predictions by the judges

24 June, 2024

Jasmine Batra’s Breakthrough Moment

24 June, 2024

WithYouWithMe’s Breakthrough Moment

24 June, 2024

Paz Pisarski’s Breakthrough Moment

20 June, 2024

UpStock’s Breakthrough Moment

20 June, 2024

Calling Brisbane — a rising star to enter!

19 June, 2024

How to choose the right category for the Pause Awards?

17 June, 2024

Success stories of past Pause winners

17 June, 2024

Your guide to the Pause Awards entry process

17 June, 2024

Understanding the breakthrough question

17 June, 2024

Top 10 tips on how to enter Pause Awards

17 June, 2024

Calling Sydney — a powerhouse of opportunity to enter!

6 June, 2024

Inke’s Breakthrough Moment

6 June, 2024

ReSource’s Breakthrough Moment

3 June, 2024

Brittany Garbutt’s exchange with Paul Bassat on building and sustaining a business empire

21 May, 2024

Entering Pause Awards for the first time?

21 May, 2024

Inside the Pause Awards 2024: A universe of possibility

14 May, 2024

What’s a Pause Awards breakthrough?

14 May, 2024

Marcella Romero’s Breakthrough Moment

9 May, 2024

Music Health’s Breakthrough Moment

2 May, 2024

Chau Le’s Breakthrough Moment

30 April, 2024

Tanck’s Breakthrough Moment

26 April, 2024

Macro Mike’s Breakthrough Moment

23 April, 2024

Birchal’s Breakthrough Moment

18 April, 2024

Tixel’s Breakthrough Moment

16 April, 2024

Redefining success with Angus and Neil of Tanck

15 April, 2024

Quad Lock’s Breakthrough Moment

12 April, 2024

Origin Energy’s Breakthrough Moment

10 April, 2024

Mel Stubbing’s breakthrough moment

5 April, 2024

Brittany Garbutt’s breakthrough moment

2 April, 2024

InvestorHub’s Breakthrough Moment

28 March, 2024

Kollektive’s Breakthrough Moment

26 March, 2024

Talking robots and AI Agents, two insane demos

25 March, 2024

Fight Club and Zombie VCs

25 March, 2024

WeMoney’s breakthrough moment

20 March, 2024

Addressing gender inequality with 21.7% discount for female-led companies

8 March, 2024

How Entertainment Brands are winning hearts and minds

5 March, 2024

2023 packed a punch

17 January, 2024

The power of relationships with Dom Pym at Pause Awards Night

19 December, 2023

Six years of celebrating the Australian most ambitious innovators

5 December, 2023

M&A green shoots & scandal central

10 November, 2023

Announcing the 63 ambitious finalists, 3 winners and Pause Awards Night

30 October, 2023

Can optimism and curiosity win the battle with Ai

20 October, 2023

Looking at 100 years from now in Solar, EVs and MedTech

20 October, 2023

What does the Australia’s VC landscape look like in 2050

19 October, 2023

Do we want to live in a Black Mirror world?

17 October, 2023

Four new emerging directors envision sustainable future beyond 2050

6 October, 2023

Visible Founders puts a spotlight on migrant entrepreneurs

28 September, 2023

Strong commitment needed to run tech events in Australia revealed at GEC23

24 September, 2023

iPhone 15 event: everything about Apple’s new product line

14 September, 2023

Discover the colourful world of oral hygiene with Dsmile’s new range

13 September, 2023

How to build a company culture in dynamic market

8 September, 2023

The valuable startup lessons hidden in the film Oppenheimer

7 September, 2023

Meet the new addition to the Judging Board ‘23

4 September, 2023

Advice on Design Thinking for stellar product development

1 September, 2023

How Pause Awards can put your brand on the map

30 August, 2023

Seize the moment: New Extended Entry Deadline

30 August, 2023

I got 99 problems

26 August, 2023

Is AI the new frontier of creativity and business

25 August, 2023

Tech legends unite to guide growth and foster innovation

22 August, 2023

The new faces of Pause Awards in business and the product officers

21 August, 2023

Don’t miss out on the last chance to join champions

21 August, 2023

Experience is a new frontier for brands

18 August, 2023

How to grow an idea into a great product

11 August, 2023

Good storytelling and trust will fuel startup and brand growth

4 August, 2023

Twitter to X: a rebrand to challenge tech giants and empower users

4 August, 2023

Discover the latest tech predictions of 2023

1 August, 2023

Elevate your business with Stephen Hunt’s success secrets

31 July, 2023

Lean into digital marketing trends now and in 2024

28 July, 2023

The new faces of Pause Awards from agency and media innovation

25 July, 2023

Hit it, DJ! and other local newsings

24 July, 2023

Female-led ethical fintech Verve raises $3M for Verve Money

21 July, 2023

How to better tune into your success journey

21 July, 2023

Pause Fest’s BREAK–THROUGH SESSIONS will keep you scaling

12 July, 2023

How to choose the right awards for your business

5 July, 2023

The new faces of Pause Awards in strategy and leadership

4 July, 2023

We’re building the community for the most ambitious people

27 June, 2023

It was worth waiting for these unique features

26 June, 2023

Mapping the future of fit and function

23 June, 2023

Midnight Health secures $24 million funding boost

21 June, 2023

Championing breakthroughs in today’s business world

21 June, 2023

OpenAI’s Sam Altman says hai

19 June, 2023

Top 5 compelling reasons why you should enter

18 June, 2023

Pause Awards vs Webby’s, Cannes Lions and Effies

18 June, 2023

The new faces of Pause Awards in startup, product and experience

15 June, 2023

A tour of 11 new categories

12 June, 2023

Inside out of Pause Awards

5 June, 2023

Aim for the Diamond: Understanding the Different Categories

1 June, 2023

The new faces of Pause Awards in strategy, growth and innovation

30 May, 2023

Where business recognition gets a paradigm shift

24 May, 2023

Industry leaders predict a transformative year ahead

17 May, 2023

Pause Awards grows to $412 Billion ecosystem

17 May, 2023

Shaking it up with new Investable Score™

17 May, 2023

Tap into your inner powerhouse

5 May, 2023

Life in the fast (tech) lane

24 April, 2023

evee rides the electric wave

18 April, 2023

Big win for the female-led business Circle In, lands $2 Million

14 April, 2023

Designing global empires:

How local brands can conquer the world

10 April, 2023

A passionate pursuit for Healthcare reinvention

4 April, 2023

The game-changing sessions at SXSW Sydney

30 March, 2023

Top AI tools you need to try now

29 March, 2023

A journey to revolutionising healthy school lunches

28 March, 2023

Panic! at the SVB & metrics that matter

16 March, 2023

Call for Entries

opens on 17 May ‘23

1 March, 2023

Startup funding in decline, but early-stage hits peak in Aus

10 February, 2023

Music for wellbeing:

The healing power of sound

20 January, 2023

Deep dive with ChatGPT about Aussie tech ecosystem

17 January, 2023

How it started; How it’s going 2022

17 December, 2022

Learning from mistakes and how to tackle the upcoming headwind

14 December, 2022

Claiming your PauseNFT trophy

13 December, 2022

Women and purpose led businesses take the most wins at Pause Awards ‘22

6 December, 2022

Professor Fiona Wood – The pioneer of ‘Spray-on-Skin’ technique, ReCell.

6 December, 2022

Rise and Demise

28 November, 2022

Let’s have breakfast with champions?

15 November, 2022

82 Bold Finalists Announced for the Pause Awards ‘22

10 November, 2022

Judge Sessions with Lumigo, Tribal DDB and Clipboard Hospitality

24 October, 2022

Judge Sessions with LongView, Fullstack and Art Processors

20 October, 2022

The first look at the new wearable trophy design

13 October, 2022

The Public Voting is open, go get them!

10 October, 2022

Cash to splash & other VC news

2 October, 2022

The Final Deadline Extended to midnight 14 October

30 September, 2022

Judge Sessions with Wavia, SEIKK and MedTech Actuator

26 September, 2022

Pause Awards Wins Australia’s International Good Design Awards for Design Excellence

19 September, 2022

Judge Sessions with Synergy Group, AOK Creative and i4 Connect

16 September, 2022

A word with Birchal’s Co-Founder – Matt Vitale

6 September, 2022

What can Pause Awards bring to your company

30 August, 2022

Google, Synergy Group, Spaces Interactive, Safari and By Jacs judges for Culture categories

24 August, 2022

Loyal VC, Media.Monks, AOK Creative, Storyfolk and Irene Lemon judges for Good categories

15 August, 2022

Fullstack, Lumigo, Netambition, MedTech Actuator and Unhedged judges for Operators categories

10 August, 2022

A word with Heaps Normal’s Head of Brand – Peter Brennan

9 August, 2022

Tribal DDB, We Are Unity, Bullfrog, BeautifulAgile and The Audacious Agency judges for your Excellence

2 August, 2022

Simply Wall Street, IBM, Forestlyn, CFOWorx and Accenture Song are this year Growth Judges

1 August, 2022

Venture snapshot: down but not out

26 July, 2022

Best equity crowdfunding year in Australia – $86m!

22 July, 2022

How to navigate the awards Entry Portal?

14 July, 2022

Startup Genome ecosystem report 2022 review

10 July, 2022

We’re giving a voice to our community with a stylish newsroom design

10 July, 2022

Professor Martin Green

– The father of solar cells

10 July, 2022

Dr John O’Sullivan

– The inventor of modern WiFi

10 July, 2022

14 New award categories under five tracks to highlight the ecosystem success

5 July, 2022

M&A on the rise & the EV SPAC demise

29 June, 2022

Our new vision:

The home for champions

27 June, 2022

Awards LIVE Briefing and Entry Kit

22 June, 2022

The Porsche of awards programmes with community at its heart

21 June, 2022

The Sheet Society

– Success Stories

17 June, 2022

We’re looking for our final few judges – could you be one?

8 June, 2022

Single Use Ain’t Sexy

– Success Stories

1 June, 2022

Afterpay

– Success Stories

24 May, 2022

This is how we celebrate innovation champions

15 December, 2021

The most ambitious and forward-thinking companies in Australia revealed

24 November, 2021

Pause Awards 2021 Finalists Skyrocket

17 November, 2021

Final Deadline is Looming

1 September, 2021

Get to know:

Carolyn Breeze – Judge

24 August, 2021

Get to know:

Will Hayward – Judge

17 August, 2021

Get to know:

Shamila Gopalan – Judge

10 August, 2021

Get to know:

Tom Leyden – Judge

3 August, 2021

Get to know:

Jules Brooke – Judge

26 July, 2021

Get to know:

Jamie Finnegan – Judge

18 July, 2021

Early Entries end This Week

12 July, 2021

Need Help Entering Pause Awards?

6 July, 2021

2021 Award Category Guide

1 July, 2021

How to Enter The Pause Awards in 7 min?

25 June, 2021

Get to know:

Melanie Rayment – Judge

24 June, 2021

Past winners:

where are they now?

24 June, 2021

Pause Awards 2021 opens for entries

9 June, 2021

New categories revealed for Pause Awards 2021

5 June, 2021

Meet the Judging Board 2021

13 May, 2021

The Reign in the North

1 February, 2021

What went into creating Vincent, a hyper-real digital human

21 January, 2020

Dane O’Shanassy on Patagonia’s moral compass and commercial success

6 November, 2019

Pause index

Sophie Walker

Women In Business

Carers Couch

B-Good

DiaperRecycle

Circular Pioneer

Chelsea Newell

Do You Know Who I Am

LunchFox

I Wish I'd Done That

1Breadcrumb

On The Rise

Marketplacer

Hammer

Angela Harbinson

Women In Business

Atticus

Small & Mighty Culture, Going Global

Providoor

I Wish I'd Done That

Kate Pollard

Women In Business